Being a student is definitely one of the best times you will ever have but there are a few things that you might not pay attention much and it relates to your credit. See, borrowing student loans, opening credit cards is one thing but building a great credit as a student and becoming way ahead of your peers after you graduate is another unique and great thing you can do to improve many aspects in life that are about to come after you enter real life after college.

Let’s take an example, you graduate and you have a bad credit score which is usually below 700, you go and get that dream car you wanted or even apply for your dream job. In the car case, the interest rate for your loan is always determined by your credit score, also insurance premiums will vary depending on your credit score.

In the job case, many jobs these days could disqualify you if you have a bad credit. Thing is, they cannot legally do that but they will find their way to disqualify you for some other reason and unfortunately you cannot chase them down over that decision even if you think you are just perfect fit for the position you applied for.

The whole purpose of this article and where I am going with it is that having a bad credit score can really affect you in a variety of ways that have a major impact on your life. Your score being bad could be costing you thousands of dollars where you could have earned from the job you didn’t get, or paying high interest rates on your loans. All because of the bad credit score.

Luckily, you don’t have to be in that position and I don’t want you to be in it either. There are more than enough of things you can do and are available that you can do to improve your credit score.

If you are just starting out college then I hope you find this article helpful and will follow the steps I discuss and apply them over your college career. If you are half-way or nearing the end, this might be a perfect time opportunity for you to start working on your credit score and improve it before you enter the real world.

So, start using the tips I provide below and improve credit score by 100+ points in just 6 months, if this sounds good to you, then let’s get started.

1. Find Where You are Standing with Your Credit

This is absolutely important! You need to first find where you are standing if you don’t already know. The first thing you need do is to determine what your score is. There are many websites to determine your credit score but as the saying goes, you get what you pay for. You can find many agencies but the one and only that is widely accepted and I’m sure you heard of is MyFico. This is a credit bureau that is used by over 90% of lenders which means that you can get best possible report for you to see where you are standing. You can get 20% off by using this link (report from all 3 bureaus) which cuts the price down to $15.95 from $19.95. This is a great investment if you want to see exactly where you are standing. MyFico also has month-by-month available for you to keep track of your reports on monthly basis if you want to know how you are improving monthly.

After you get your official report or you already have it, I highly recommend reading my post on Credit Karma and open account with them. This is a 100% free credit website that provides you with so much information relating to your credit and much more like car value, taxes filing, credit card ratings, approval chances, and much more you can find in my post.

By law you can get a free credit report annually. So, head over to Annual Credit Report and get your free report. Keep in mind, it is a credit report and not a credit score.

2. Address the Credit Errors (you either owe or you don’t owe money)

If somebody came up to you and told you that you owe them $50, are you just going to fork over the money? What are you going to do? You will investigate it on why do you owe them $50. After you obtained the credit report, go over everything and make sure that there are no errors, if you see something that you believe is a mistake, call and ask that company to prove that you owe them the money.

This could potentially help you to get rid of bad marks if something is an error on your credit report. So, put some money into the MyFico report I talked above and review everything. Your time and money you spend will be well worth it comparing to the alternative of having a bad credit score.

3. Fixing Credit Problems

Assuming you did step above and know where you are standing. As you can seen the image above, the best way to improve your credit score is to always pay your bills on time. Did you know that missing just one bill could cost you 100 points?

While this is I hope basic information to you, know that it is very important to pay your bills on time and never ever miss them. You can find much more information on building a great credit in my other post.

4. The Secret Behind Raising the Credit Score Faster

The secret is that you don’t have to spend on the credit card, you can pay some bill that you have like your phone bill and set up auto-pay or automatic full payment to that credit card using your checking account. This way your credit card is used but you are not actually using it.

If you don’t have a credit card, apply for one and choose wisely and get one where you will actually benefit from. I highly recommend Discover it credit card to anybody because of it’s 5% cash back on rotating categories every quarter and they match your first years cash back earned and double it. It is a fantastic offer and really the best credit card for students. Another great option if you dine out a lot is the Blue Delta SkyMiles Credit Card which gives two miles per dollar spent on dining out.

5. Work on Two Major Credit Factors for 6 Months

The two major credit score factors that make up approximately 65% of your credit are: how much you owe and payment history.

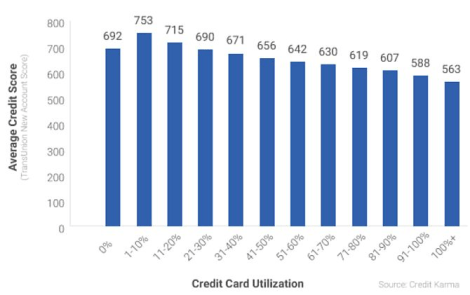

How much you Owe: Let’s say you have a credit card and your credit limit is $1,000. Don’t get near that $1,000 unless you pay it off within that month’s statement. I suggest using only up to 25% of you available credit, in this case 25% is $250. If your credit limit is lower or you are just starting out with a credit card it might be harder as the 25% rule will put your usage in terms of cash lower. The lesson to get from this is to not have 25% or more in utilization.

Here’s interesting graph by Credit Karma from 15 million people who are using Credit Karma. As you can see people with 0% had even lower credit score than those from 1-10%.

Payment History: Just as the name itself suggests, paying on time is another large chunk what makes up your credit score. Think about this, if you went out with three of your friends to the restaurant or wherever you go out to (they only accept cash) and somehow you are the only one who had cash on hand. You paid for all your friends and they said they will pay it back the next day. Well, one paid the next day and the other two said the next day. Then day’s, month’s, even years pass by and you never got your money that you paid for the other two. The consequence? Well, you just spent your hard-earned money that you could have spent on something else for yourself or even invested it. The lesson here is that you are using that bank’s money to buy something and if you don’t pay back, you face the consequences of hurting your credit score.

6. Maxed Out Credit Limit, Not Making Enough Money… What to do?

Here’s the thing, you are not the only one that has cards maxed and primarily it is because you are spending more than you can actually afford and that’s just how it is with credit because this money is not really yours, you are borrowing this money. Since my blog is for students, I mainly focus on students, see my post on ways to make money while working towards a degree, get a side hustle and very importantly pay off your credit card debts especially as summer coming up and it marks the best time to make money but at the same time have fun. See how to make the most out of your summer break.

Bottom Line

I hope you found this article informing and please feel free to share your stories of going from debt to debt-free. Especially if you are a student and struggling financially but trying to avoid the debt like a plague I really admire you for that, you are on the right path to success. By following these tips I talked above, you can raise you credit score by more than 100 points in 6 months. Having a good credit score whether you like it or not, if you ever plan buying a car, taking out mortgage, or starting a business, you’ll need at least a good credit score to qualify for the best rates.

I would never call money a good or evil, it is an accessory that helps you build a life you desire.

Recommended for you to read:

Get Free Money by Opening Account with the Best Micro Investing App

Is Credit Card a Smart Choice for you?

Review of Credit Karma and it’s large variety of FREE benefits having an Account

15 Cheap and Best Mother’s Day Gift Ideas for the Student Budget or Just on Budget

Top 10 Highest Paying Jobs that Don’t Require Degree

Is it Time to Upgrade Your Phone?

Richard Barnett is a student majoring in finance, entrepreneur, marketer, content writer, budget traveler, and financial blog “Student Money Adviser” owner. You can read more about me here.

Pingback: 6 Crucial Personal Finance Lessons High School Need to Teach | Student Money Adviser

Pingback: Personal Finance Books You Absolutely MUST Read in Your 20's | Student Money Adviser